Monzo banking has revolutionized the way people manage their finances in the digital age. As one of the pioneering digital banks in the United Kingdom, Monzo has captured the attention of millions of users seeking a more convenient and transparent banking experience. This comprehensive guide will explore everything you need to know about Monzo banking, from its origins to its current offerings and future prospects.

The financial landscape has undergone significant transformation in recent years, with digital banking emerging as a game-changer in personal finance management. Monzo's innovative approach to banking services has made it a popular choice among tech-savvy consumers who demand instant access to their financial information and seamless transaction capabilities. Understanding Monzo's unique features and benefits is crucial for anyone considering making the switch to digital banking.

In this article, we'll delve deep into Monzo's banking services, examining its account features, security measures, customer support, and how it compares to traditional banking institutions. We'll also explore the bank's impact on the financial industry and what sets it apart from other digital banking solutions. Whether you're a long-time Monzo user or considering opening an account, this guide will provide valuable insights into what makes Monzo banking a standout choice in today's digital financial ecosystem.

Read also:Unveiling The Mystique Of Mary Beth Roes Age

Table of Contents

- Monzo Banking Overview

- History and Evolution of Monzo

- Key Features and Services

- Security Measures and Protections

- Customer Support and Service Quality

- Monzo vs Traditional Banking

- Monzo's Impact on Personal Finance

- User Experience and Interface Design

- Future Developments and Expansion Plans

- Conclusion and Final Thoughts

Monzo Banking Overview

Monzo banking represents a new paradigm in financial services, combining cutting-edge technology with user-friendly features to create a seamless banking experience. Founded in 2015, Monzo initially launched as a prepaid debit card before evolving into a fully-fledged digital bank. Today, Monzo serves over 8 million customers across the UK, offering a range of financial products and services that cater to modern banking needs.

At its core, Monzo banking provides users with a mobile-first banking experience that prioritizes convenience, transparency, and control. The bank's app-based platform allows customers to manage their finances on-the-go, with features such as real-time transaction notifications, automated budgeting tools, and instant spending insights. Monzo's commitment to digital innovation has earned it numerous awards and recognition in the fintech industry.

History and Evolution of Monzo

Monzo's journey began in February 2015 when it was founded by Tom Blomfield, Jonas Huckestein, Jason Bates, Paul Rippon, and Gary Dolman. Initially operating under the name "Mondo," the company launched its beta testing phase with just 1,000 prepaid cards. The overwhelming demand for these cards led to the company's rapid growth and eventual rebranding to Monzo in 2016.

Key milestones in Monzo's development include:

- 2016: Launch of the Monzo current account

- 2017: Achievement of full UK banking license

- 2018: Introduction of joint accounts

- 2019: Expansion into business banking

- 2020: Launch of investment products

The bank's evolution reflects its commitment to adapting to changing consumer needs and technological advancements. Monzo's growth strategy has focused on building a robust digital infrastructure while maintaining its startup agility and customer-centric approach.

Key Features and Services

Monzo banking stands out for its comprehensive suite of features designed to enhance the user experience. The platform offers:

Read also:Exploring The Life And Achievements Of Joanna Freeman

- Instant transaction notifications

- Automatic spending categorization

- Budgeting tools and spending insights

- International spending with fair exchange rates

- Round-up savings feature

What sets Monzo apart is its ability to provide real-time financial data and insights. The app's intuitive interface displays spending patterns, balance information, and personalized recommendations, empowering users to make informed financial decisions.

Types of Accounts Offered

Monzo banking caters to diverse customer needs through various account options:

- Personal Current Accounts

- Joint Accounts

- Business Accounts

- Monzo Plus (premium account)

- Monzo Business Pro

Each account type comes with specific features and benefits tailored to different user requirements. For instance, the Monzo Plus account offers additional perks such as travel insurance and lounge access, while Business Pro provides advanced tools for managing company finances.

Digital Banking Tools

Monzo's digital tools have transformed traditional banking processes:

- Instant account freezing and unfreezing

- Automatic bill splitting

- Energy switching service

- Salary advance options

- Investment opportunities

These tools demonstrate Monzo's commitment to simplifying financial management while providing value-added services that go beyond basic banking functions.

Security Measures and Protections

Monzo banking prioritizes security through multiple layers of protection:

- Biometric authentication (fingerprint and facial recognition)

- Instant fraud alerts

- 24/7 account monitoring

- Freeze/unfreeze card functionality

- Secure chip-and-PIN technology

The bank's security protocols align with industry standards and regulatory requirements, ensuring customer funds are protected up to £85,000 under the Financial Services Compensation Scheme (FSCS). Monzo's proactive approach to security has earned it trust among users, with fraud rates significantly lower than industry averages.

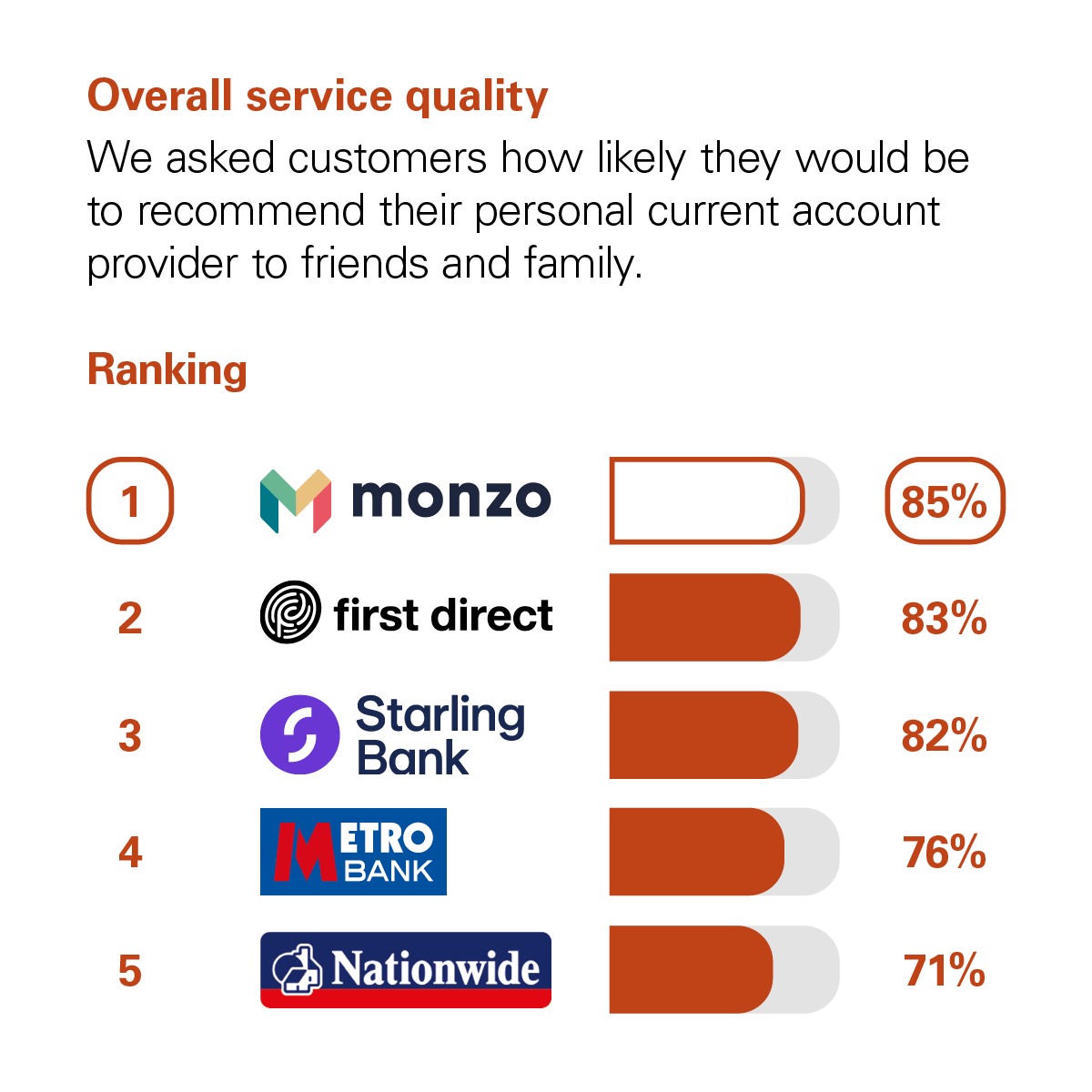

Customer Support and Service Quality

Monzo's customer support sets it apart from traditional banks:

- 24/7 in-app chat support

- Comprehensive help center

- Community forum for peer support

- AI-powered chatbot for quick queries

- Human support for complex issues

The bank's commitment to excellent customer service is reflected in its consistently high satisfaction ratings. Monzo's support team resolves most queries within minutes, with an average response time of 120 seconds during peak hours.

Monzo vs Traditional Banking

When comparing Monzo banking to traditional banks, several key differences emerge:

| Feature | Monzo Banking | Traditional Banks |

|---|---|---|

| Account Opening | 100% digital process | Requires branch visit |

| Transaction Notifications | Instant alerts | Delayed notifications |

| Customer Support | 24/7 in-app chat | Limited branch hours |

| International Fees | 0% fees on transactions | Up to 3% fees |

| Overdraft Rates | Competitive rates | Higher rates |

These differences highlight Monzo's advantages in terms of convenience, transparency, and cost-effectiveness.

Monzo's Impact on Personal Finance

Monzo banking has significantly influenced how individuals manage their finances:

- Increased financial awareness through real-time insights

- Improved budgeting through automated tools

- Reduced unnecessary spending through instant notifications

- Enhanced financial inclusion for underserved populations

- Streamlined international transactions

Studies show that Monzo users report better financial health metrics compared to traditional bank customers, including higher savings rates and improved credit scores.

User Experience and Interface Design

Monzo's user interface exemplifies best practices in digital banking design:

- Intuitive navigation

- Customizable dashboard

- Clear visualizations of financial data

- Seamless integration with other services

- Regular feature updates

The app's design philosophy centers around simplicity and functionality, ensuring users of all technical backgrounds can effectively manage their finances. Monzo's consistent app updates reflect its commitment to maintaining a cutting-edge user experience.

Future Developments and Expansion Plans

Monzo banking continues to evolve with several exciting developments on the horizon:

- Expansion into new international markets

- Introduction of additional financial products

- Enhanced AI-driven financial insights

- Partnerships with other fintech companies

- Development of advanced business banking solutions

These initiatives demonstrate Monzo's ambition to become a comprehensive financial ecosystem rather than just a digital bank.

Conclusion and Final Thoughts

Monzo banking has established itself as a leader in the digital banking revolution, offering users a powerful combination of convenience, transparency, and innovative features. From its humble beginnings as a startup to its current position as one of the UK's most popular digital banks, Monzo has consistently demonstrated its commitment to improving personal finance management.

The bank's success can be attributed to its focus on user experience, technological innovation, and customer-centric approach. As Monzo continues to expand its offerings and explore new markets, it remains well-positioned to shape the future of banking. Whether you're considering switching to Monzo or simply curious about digital banking options, this comprehensive guide has hopefully provided valuable insights into what makes Monzo banking a compelling choice.

We encourage you to share your thoughts and experiences with Monzo banking in the comments below. Have you found this guide helpful? Please consider sharing it with others who might benefit from learning about Monzo's services. For more information on digital banking solutions and personal finance management, explore our other articles on modern banking innovations.