State Farm auto coverage codes play a critical role in helping policyholders understand the specifics of their auto insurance policies. Whether you're a new driver or someone looking to refine your existing policy, these codes provide clarity on what is covered and what isn't. State Farm, one of the largest and most trusted insurance providers in the U.S., uses these codes to categorize various aspects of auto insurance coverage, ensuring transparency and accuracy. In this article, we will explore the intricacies of State Farm auto coverage codes, their importance, and how they can impact your policy.

Auto insurance can often feel overwhelming due to its complexity. However, understanding the codes associated with your policy can make the process much easier. These codes are essentially shorthand for the different types of coverage included in your policy, such as liability, collision, comprehensive, and more. By familiarizing yourself with these codes, you can ensure that you have the right coverage for your needs and avoid unexpected expenses in the event of an accident or other incidents.

In this comprehensive guide, we will break down the various State Farm auto coverage codes, explain their meanings, and provide practical insights into how they affect your insurance policy. Whether you're looking to decode your policy documents or simply want to learn more about auto insurance, this article will equip you with the knowledge you need to make informed decisions. Let's dive into the details and demystify State Farm auto coverage codes.

Read also:Unveiling The Mystery Of Bigtiddygothegg A Deep Dive

Table of Contents

- What Are State Farm Auto Coverage Codes?

- Importance of Understanding Coverage Codes

- Common State Farm Auto Coverage Codes

- Liability Coverage Explained

- Collision Coverage and Its Codes

- Comprehensive Coverage Breakdown

- Uninsured and Underinsured Motorist Coverage

- Additional Coverage Options

- How to Decode Your Policy Documents

- Frequently Asked Questions

What Are State Farm Auto Coverage Codes?

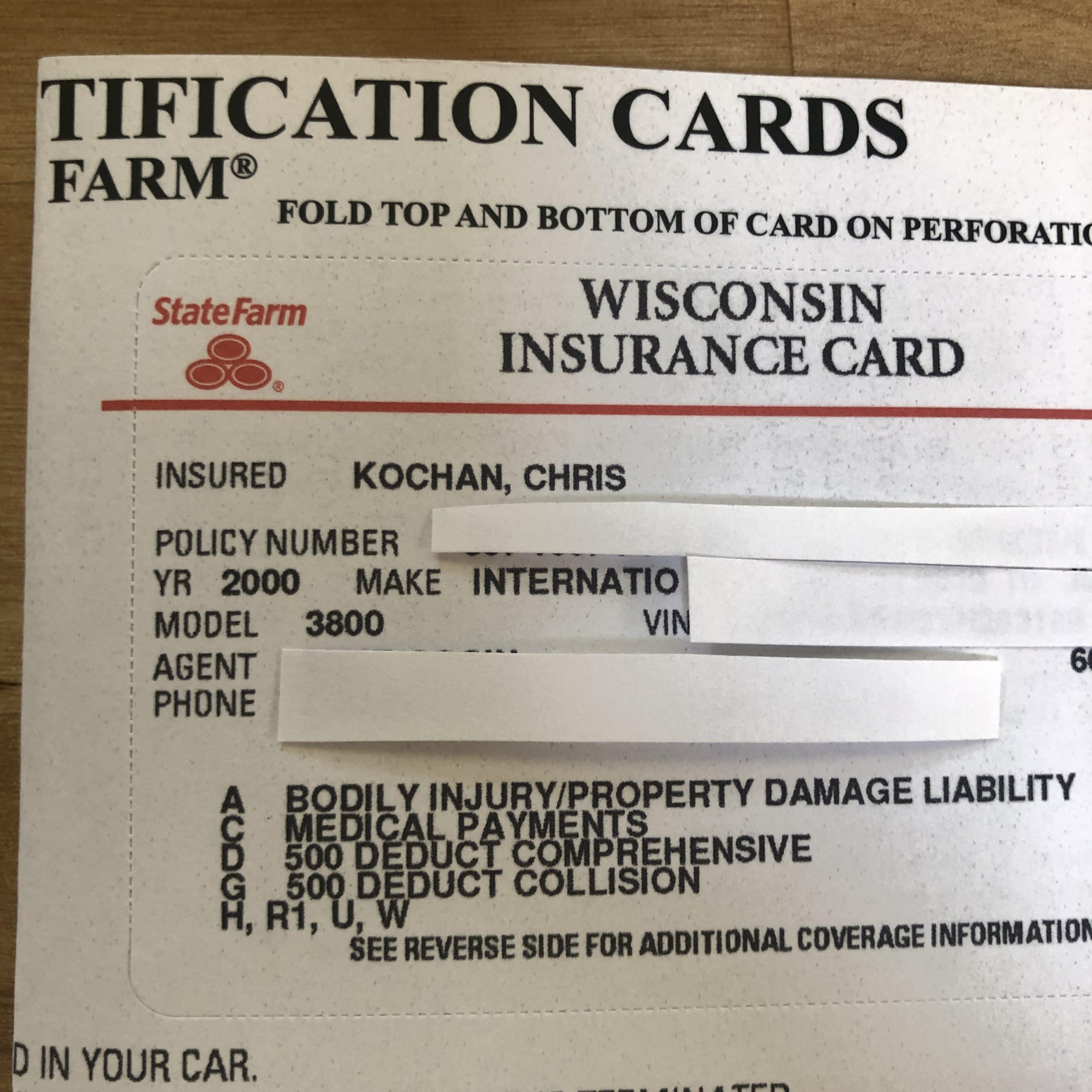

State Farm auto coverage codes are alphanumeric identifiers used to represent specific types of coverage within an auto insurance policy. These codes are standardized across State Farm's systems and are used by agents, adjusters, and policyholders to quickly identify the coverage details of a policy. For example, a code like "BI" might represent "Bodily Injury Liability," while "COLL" could stand for "Collision Coverage."

These codes are not only useful for internal purposes but also for policyholders who want to understand their coverage better. By knowing what each code means, you can verify that your policy includes the necessary protections and avoid misunderstandings during claims processing. Additionally, these codes help streamline communication between State Farm and its customers, ensuring that everyone is on the same page.

Importance of Understanding Coverage Codes

Understanding State Farm auto coverage codes is crucial for several reasons. First, it allows you to verify that your policy aligns with your needs. For instance, if you frequently drive in areas prone to theft or vandalism, you'll want to ensure that your policy includes comprehensive coverage, which is often represented by a specific code. Without understanding these codes, you might overlook critical protections.

Second, these codes can help you avoid unexpected expenses. If you're involved in an accident and your policy doesn't cover certain damages, you could be left with hefty out-of-pocket costs. By understanding the codes, you can ensure that your policy is comprehensive enough to protect you financially. Finally, knowing these codes empowers you to ask the right questions when discussing your policy with an agent, ensuring that you get the best coverage for your money.

Common State Farm Auto Coverage Codes

Let's take a closer look at some of the most common State Farm auto coverage codes and what they mean:

- BI (Bodily Injury Liability): Covers injuries you cause to others in an accident.

- PD (Property Damage Liability): Covers damage you cause to someone else's property.

- COLL (Collision Coverage): Covers damage to your vehicle from a collision with another vehicle or object.

- COMP (Comprehensive Coverage): Covers non-collision-related incidents, such as theft, vandalism, or natural disasters.

- UM (Uninsured Motorist Coverage): Protects you if you're hit by a driver without insurance.

- UIM (Underinsured Motorist Coverage): Covers damages when the at-fault driver has insufficient insurance.

How to Identify Your Coverage Codes

To identify the coverage codes in your policy, review your policy documents or contact your State Farm agent. These codes are typically listed in the "Declarations Page" of your policy, alongside the coverage limits and premiums. Understanding these codes will help you make informed decisions about your coverage.

Read also:Unveiling The Life Of Greg Gutfelds Wife A Journey Of Love And Support

Liability Coverage Explained

Liability coverage is one of the most essential components of any auto insurance policy. It is divided into two main categories: Bodily Injury Liability (BI) and Property Damage Liability (PD). These coverages are mandatory in most states and are designed to protect you financially if you're responsible for an accident.

Bodily Injury Liability (BI): This coverage pays for medical expenses, lost wages, and legal fees if you're found at fault for injuring someone in an accident. The coverage limits are typically expressed as three numbers (e.g., 25/50/25), which represent the maximum amounts covered per person, per accident, and for property damage, respectively.

Property Damage Liability (PD): This coverage pays for repairs or replacement of someone else's property that you damage in an accident. It also covers legal fees if you're sued for property damage.

Collision Coverage and Its Codes

Collision coverage, often represented by the code "COLL," is designed to cover damage to your vehicle resulting from a collision with another vehicle or object. This coverage is optional in most states but is highly recommended, especially if you have a newer or more expensive car.

One key aspect of collision coverage is the deductible, which is the amount you must pay out-of-pocket before your insurance kicks in. For example, if your deductible is $500 and the repair costs are $2,000, you'll pay $500, and your insurance will cover the remaining $1,500. Understanding this code and its implications can help you choose the right deductible for your budget.

When to Opt for Collision Coverage

Collision coverage is particularly beneficial if you live in an area with heavy traffic or if you frequently drive in adverse weather conditions. It can also be a wise choice if your vehicle is leased or financed, as lenders often require this coverage.

Comprehensive Coverage Breakdown

Comprehensive coverage, often abbreviated as "COMP," protects your vehicle from non-collision-related incidents. This includes events like theft, vandalism, fire, natural disasters, and collisions with animals. Like collision coverage, comprehensive coverage is optional but highly recommended for added peace of mind.

Comprehensive coverage also comes with a deductible, which you'll need to pay before your insurance covers the remaining costs. For example, if your car is stolen and the replacement cost is $15,000, and your deductible is $1,000, your insurance will cover $14,000.

Key Scenarios Covered by Comprehensive Coverage

- Theft or vandalism of your vehicle.

- Damage caused by falling objects, such as tree branches.

- Fire or explosion.

- Damage from hitting an animal, such as a deer.

Uninsured and Underinsured Motorist Coverage

Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverages are critical protections that safeguard you in the event of an accident with a driver who lacks sufficient insurance. These coverages are often abbreviated as "UM" and "UIM" in State Farm policies.

Uninsured Motorist Coverage (UM): This coverage pays for your medical expenses and damages if you're hit by a driver without insurance. It can also cover hit-and-run accidents.

Underinsured Motorist Coverage (UIM): This coverage steps in when the at-fault driver's insurance limits are too low to cover your damages. For example, if the at-fault driver has $25,000 in liability coverage but your damages total $50,000, UIM coverage can help bridge the gap.

Why UM and UIM Coverage Matter

According to the Insurance Information Institute, approximately 12% of drivers in the U.S. are uninsured. This statistic underscores the importance of UM and UIM coverage, as it ensures you're protected even if the at-fault driver cannot pay for your damages.

Additional Coverage Options

In addition to the core coverages discussed above, State Farm offers several optional coverages that can enhance your policy. These include:

- Rental Reimbursement: Covers the cost of a rental car while your vehicle is being repaired.

- Towing and Labor: Provides coverage for towing services and minor repairs, such as a flat tire or dead battery.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault.

How to Choose the Right Add-Ons

When selecting additional coverage options, consider your driving habits, vehicle type, and financial situation. For example, if you rely heavily on your car for daily commuting, rental reimbursement coverage might be a worthwhile investment.

How to Decode Your Policy Documents

Decoding your policy documents can seem daunting, but it's a crucial step in understanding your coverage. Start by reviewing the "Declarations Page," which summarizes your policy details, including coverage codes, limits, and premiums. Next, look for a glossary or explanation of terms, which often includes definitions of the codes used in your policy.

If you're unsure about any codes or terms, don't hesitate to contact your State Farm agent. They can provide clarification and help you understand how each coverage applies to your policy.

Frequently Asked Questions

Q: What happens if I don't understand a coverage code in my policy?

A: Contact your State Farm agent for clarification. They can explain the code and its implications for your coverage.

Q: Are State Farm auto coverage codes standardized across all states?

A: While many codes are consistent, some may vary depending on state regulations and requirements.

Q: Can I add or remove coverage options after purchasing a policy?

A: Yes, you can adjust your coverage at any time by contacting your agent. However, changes may affect your premium.

Conclusion

Understanding State Farm auto coverage codes is essential for ensuring that your policy meets your needs and provides adequate protection. By familiarizing yourself with these codes, you can make informed decisions about your coverage and avoid unexpected expenses. Whether you're reviewing your current policy or shopping for a new one, this knowledge will empower you to navigate the complexities of auto insurance with confidence.

If you found this guide helpful, consider sharing it with friends or family who might benefit from it. Additionally, feel free to leave a comment below with any questions or insights. For more information on auto insurance and related topics, explore our other articles on this site. Stay informed, stay protected!