Postal orders have long been a reliable and secure method of transferring money through the postal system. Whether you're sending money domestically or internationally, postal orders provide a convenient alternative to cash and checks. They are particularly useful when you need to send money to someone who doesn't have a bank account or when you want to ensure that the payment is secure. In this article, we will explore everything you need to know about postal orders, including their history, how they work, their advantages, and how to use them effectively.

Postal orders are a form of prepaid financial instrument that allows you to send a specific amount of money through the mail. Unlike checks, postal orders are prepaid, which means that the sender pays the full amount upfront, ensuring that the recipient receives the exact amount without any risk of bounced payments. This makes postal orders a popular choice for individuals who need to send money safely and securely. They are often used for small transactions, such as paying bills, sending gifts, or reimbursing friends and family.

In today's digital age, where online banking and mobile payment apps dominate, postal orders might seem like a relic of the past. However, they remain relevant for certain demographics and situations. For example, postal orders are still widely used in rural areas where access to banking services may be limited. Additionally, they are a trusted option for individuals who prefer not to share their banking details online. In the following sections, we will delve deeper into the intricacies of postal orders and why they continue to be a valuable financial tool.

Read also:Unveiling The Life Of Sean Edward Hartman A Journey Through Fame

Table of Contents

A Brief History of Postal Orders

Postal orders were first introduced in the United Kingdom in 1881 as a way to provide a secure and convenient method of transferring money through the postal system. At the time, they were particularly useful for individuals who did not have access to banks or who wanted to avoid the risks associated with sending cash through the mail. The concept quickly gained popularity and was adopted by other countries, including the United States, Canada, and Australia.

During the early 20th century, postal orders became a widely used financial instrument, especially in rural areas where banking services were limited. They were often used to pay bills, send remittances, and purchase goods by mail. The simplicity and security of postal orders made them a preferred choice for many individuals, particularly those who were wary of using checks or other forms of payment.

Over the years, the use of postal orders has declined due to the rise of electronic payment methods and online banking. However, they remain a valuable option for certain demographics, such as elderly individuals or those without access to digital payment systems. In some countries, postal orders are still issued and accepted, although their availability may vary depending on the region.

How Postal Orders Work

Postal orders are essentially prepaid financial instruments that allow you to send a specific amount of money through the postal system. When you purchase a postal order, you pay the full amount upfront, along with a small fee. The postal order is then issued in the form of a paper document that can be mailed to the recipient.

Once the recipient receives the postal order, they can cash it at a post office or a designated financial institution. Unlike checks, postal orders are prepaid, which means that there is no risk of the payment being returned due to insufficient funds. This makes them a secure and reliable method of transferring money.

Postal orders are typically available in fixed denominations, such as $10, $20, or $50, although some countries may offer custom amounts. They are often used for small transactions, such as paying bills, sending gifts, or reimbursing friends and family. In the next section, we will explore the advantages of using postal orders in more detail.

Read also:Did Diane Pol Pass Away Unraveling The Truth Behind The Rumors

Advantages of Using Postal Orders

Postal orders offer several advantages that make them a popular choice for certain individuals and situations. Below are some of the key benefits:

- Security: Postal orders are prepaid, which means that the recipient is guaranteed to receive the exact amount without any risk of bounced payments. This makes them a secure option for sending money through the mail.

- Accessibility: Postal orders are available at most post offices, making them accessible to individuals who may not have access to banking services. This is particularly beneficial for people living in rural or underserved areas.

- Convenience: Postal orders are easy to purchase and use. They can be bought at a post office and mailed directly to the recipient, eliminating the need for complex banking procedures.

- Privacy: Unlike checks, postal orders do not require the sender to disclose their banking information, providing an additional layer of privacy.

These advantages make postal orders a valuable financial tool, particularly for individuals who prioritize security and simplicity. However, there are also some drawbacks to consider, which we will discuss in the next section.

Disadvantages of Postal Orders

While postal orders offer several benefits, they are not without their drawbacks. Below are some of the potential disadvantages of using postal orders:

- Cost: Postal orders typically come with a small fee, which can add up if you need to send multiple orders. This fee may be a deterrent for individuals who are looking for a cost-effective payment method.

- Limited Availability: In some countries, postal orders are no longer widely available or accepted. This can make it difficult to use them as a reliable payment method.

- Risk of Loss or Theft: Although postal orders are secure, they are still physical documents that can be lost or stolen in transit. If a postal order is lost, it may be difficult to recover the funds.

- Fixed Denominations: Postal orders are often available in fixed denominations, which may not always align with the amount you need to send. This can be inconvenient for larger transactions.

Despite these disadvantages, postal orders remain a viable option for certain individuals and situations. In the following sections, we will explore how to buy and cash a postal order, as well as their use in international transactions.

How to Buy a Postal Order

Purchasing a postal order is a straightforward process that can be completed at most post offices. Below are the steps you need to follow to buy a postal order:

- Visit a Post Office: Locate your nearest post office and inquire about the availability of postal orders. Some post offices may require you to fill out a form or provide identification.

- Specify the Amount: Decide on the amount you wish to send and inform the post office staff. Postal orders are typically available in fixed denominations, so you may need to purchase multiple orders if the amount exceeds the maximum limit.

- Pay the Fee: In addition to the amount of the postal order, you will need to pay a small fee. The fee varies depending on the country and the amount of the postal order.

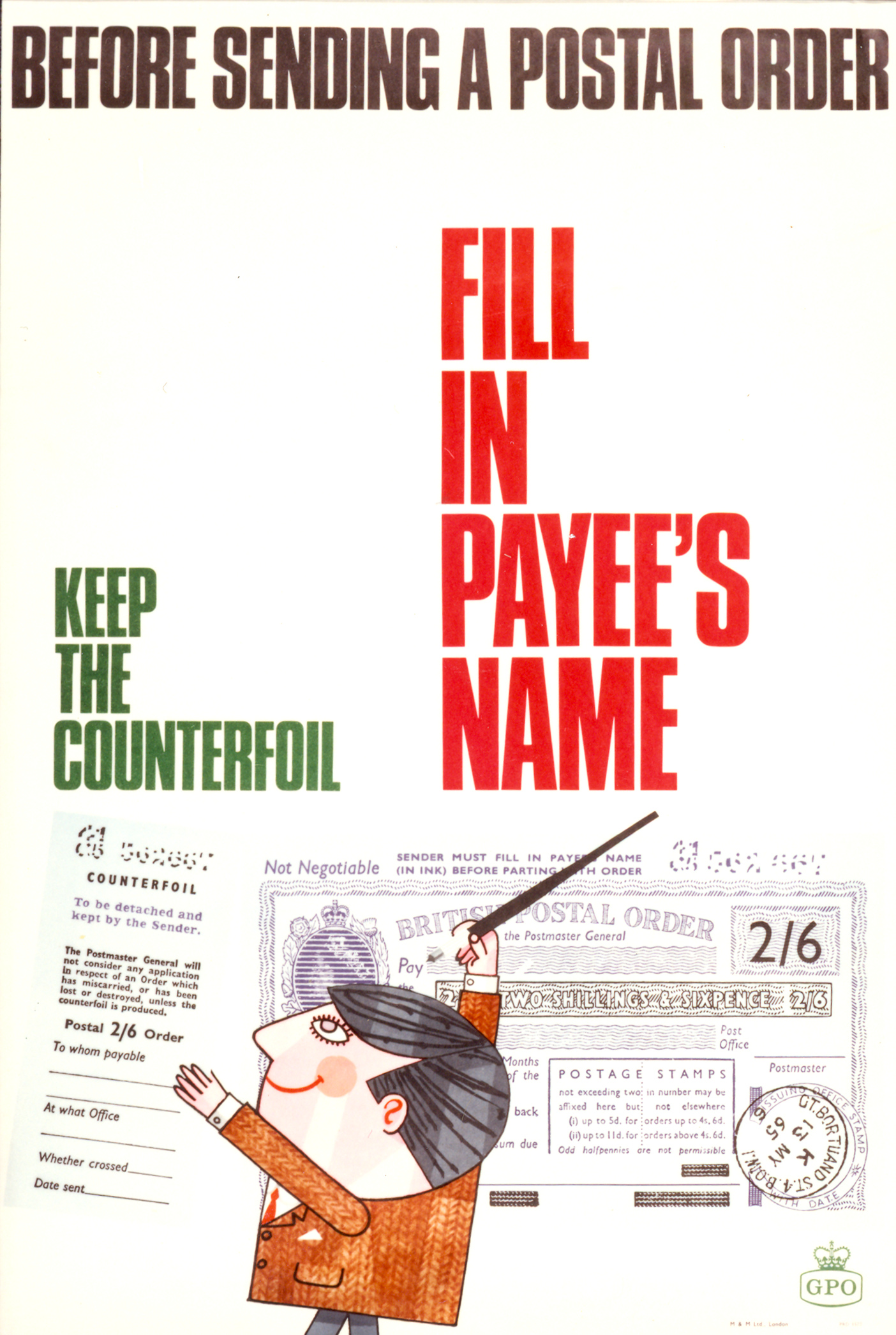

- Receive the Postal Order: Once the payment is complete, you will receive the postal order in the form of a paper document. Make sure to fill in the recipient's name and address before mailing it.

By following these steps, you can easily purchase a postal order and send it to the intended recipient. In the next section, we will discuss how to cash a postal order.

Important Considerations

When purchasing a postal order, it's important to ensure that you fill in the recipient's details accurately to avoid any issues. Additionally, keep the receipt as proof of purchase in case the postal order is lost or stolen.

How to Cash a Postal Order

Cashing a postal order is a simple process that can be completed at most post offices or designated financial institutions. Below are the steps you need to follow to cash a postal order:

- Visit a Post Office: Take the postal order to your nearest post office or a designated financial institution that accepts postal orders. Make sure to bring a valid form of identification, such as a driver's license or passport.

- Present the Postal Order: Hand over the postal order to the staff and inform them that you wish to cash it. They will verify the details and ensure that the postal order is valid.

- Receive the Payment: Once the postal order is verified, you will receive the payment in cash or as a deposit into your bank account, depending on your preference.

It's important to note that some post offices may have specific requirements or restrictions for cashing postal orders, so it's a good idea to check in advance. Additionally, if the postal order is damaged or incomplete, it may be more difficult to cash.

Tips for Cashing Postal Orders

To ensure a smooth process, make sure to bring all necessary documentation and verify the postal order's details before visiting the post office. If you encounter any issues, contact the issuing post office for assistance.

International Postal Orders

Postal orders are not only used for domestic transactions but can also be used for international money transfers. International postal orders allow you to send money to recipients in other countries, making them a convenient option for cross-border payments.

However, it's important to note that not all countries accept international postal orders, and the availability may vary depending on the region. Additionally, the fees for international postal orders are typically higher than those for domestic orders, and the processing time may be longer.

When sending an international postal order, make sure to check the exchange rate and any additional fees that may apply. It's also a good idea to confirm with the recipient's local post office to ensure that they accept international postal orders.

Popular Countries for International Postal Orders

- United Kingdom

- United States

- Canada

- Australia

Security Features of Postal Orders

Postal orders are designed with several security features to prevent fraud and ensure that they are used safely. Below are some of the key security features of postal orders:

- Watermarks: Many postal orders include watermarks that are visible when held up to the light. These watermarks help to verify the authenticity of the document.

- Serial Numbers: Each postal order is assigned a unique serial number, which can be used to track and verify the document.

- Signatures: Postal orders often require the sender to sign the document, adding an additional layer of security.

- Encryption: Some postal orders include encrypted codes or holograms that make them difficult to counterfeit.

These security features make postal orders a reliable and secure method of transferring money, particularly for individuals who are concerned about fraud or theft.

Alternatives to Postal Orders

While postal orders remain a valuable financial tool, there are several alternatives that you may consider depending on your needs. Below are some popular alternatives to postal orders:

- Money Orders: Similar to postal orders, money orders are prepaid financial instruments that can be purchased at banks, post offices, or retail stores. They are widely accepted and offer a secure method of transferring money.

- Wire Transfers: Wire transfers allow you to send money electronically through banks or money transfer services. They are fast and convenient but may come with higher fees.

- Mobile Payment Apps: Mobile payment apps, such as PayPal or Venmo, allow you to send money digitally using your smartphone. They are convenient and widely used but may require the recipient to have access to a bank account.

- Prepaid Debit Cards: Prepaid debit cards allow you to load a specific amount of money onto a card that can be used like a regular debit card. They are a flexible option for individuals who prefer not to use cash or checks.

Each of these alternatives has its own advantages and disadvantages, so it's important to choose the option that best suits your